Debt collection: education, further education, course, seminar, training, information, schools

Debt collection: Collecting receivables independently and professionally

Questions and answers

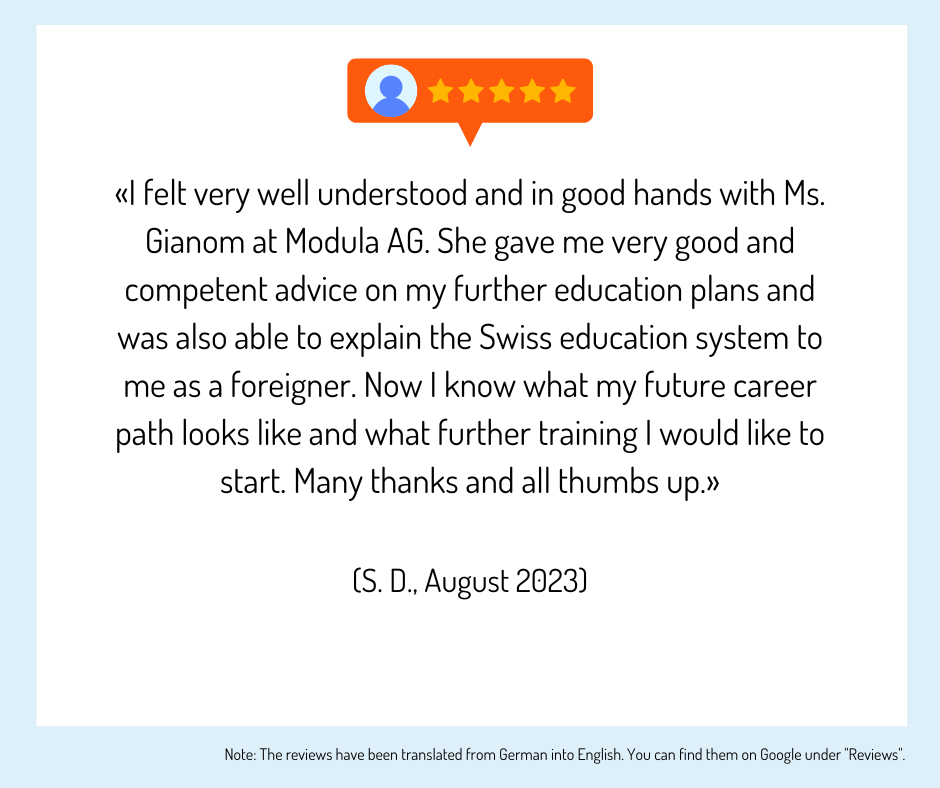

Erfahrungen, Bewertungen und Meinungen zur Ausbildung / Weiterbildung

Haven't found the right training or further education yet? Benefit from educational advice now!

Further training is not only important in order to maintain or increase professional attractiveness, investing in training or further training is still the most efficient way to increase the chances of a pay rise.

The Swiss education system offers a wide range of individual training and further education opportunities - depending on your personal level of education, professional experience and educational goals.

Choosing the right educational offer is not easy for many prospective students.

Which training and further education is the right one for my path?

Our education advisory team will guide you through the "education jungle", providing specific input and relevant background information to help you choose the right offer.

Your advantages:

You will receive

- Suggestions for suitable courses, seminars or training programs based on the information you provide in the questionnaire

- An overview of the different levels and types of education

- Information about the Swiss education system

We offer our educational counseling in the following languages on request: French, Italian, English

Register now and concretize your training plans.

Sofort zur richtigen Weiterbildung

Attraktive Services für SKO Mitglieder

Kostenlose Services

» Bildungsberatung (Wert: CHF 150.–)

Bildungs- und Businessratgeber (Wert: CHF 175.–)

» Rabatte

Attraktive Rabattierungen seitens der Bildungsanbieter.

Massgeschneiderte Bildungsangebote

Ohne grossen Zeitaufwand den besten Trainer, Coach oder Schulungsanbieter finden

Bildungsangebot Schweiz

Aus über 700 Bildungsanbietern das richtige Bildungsangebot finden